🧠 Thoughts & Readings

What’s On Deck for Business School

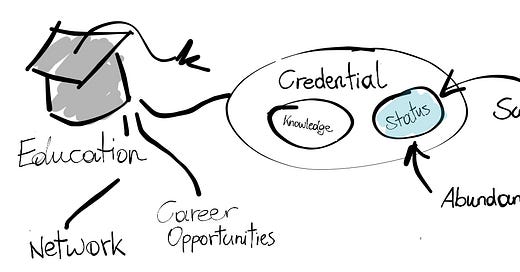

Any would-be disruptor of business school would need to nail all three of its Jobs to be Done (JTBD): (1) the network, (2) the career opportunities, and (3) the credential. This challenger would have to do so for a fraction of the cost and with a sustainable business model. Seems like a tall order.

Let’s start with the last one: the credential. In my eyes the credential serves two main purposes: (1) certifying knowledge and (2) signaling status.

Scarcity Status versus Abundance Status

Status is like money.

Like money, status is about scarcity. It is an abstract but absolute representation of what you have. It is zero-sum, and backed by something tangible. Status is a flex.

Also like money, status is about reputation. It’s about trust, generosity, and about what you’ve given away, not what you have. It can be originated into existence, or destroyed. It isn’t like a gold coin here; it’s more like an IOU. It’s an adaptation to abundance, not to scarcity.

Status is both of those things. It’s a unit of what you have, and it’s also a unit of what you’re owed.

Nowadays most of the status you can get from education is based on scarcity. Being a Harvard graduate gives you status because only around 2,000 people graduate from Harvard each year. If it were 1 million graduates this status would be gone immediately.

However, things are changing and as education becomes widely accessible online (e.g. free online courses by major universities, Coursera, Lambda School) we are moving from a situation of education scarcity to abundance. This means, also the determinants of status in this area will change [1].

Homesteading the Twittersphere

Gift cultures are adaptations not to scarcity but to abundance. They arise in populations that do not have significant material-scarcity problems with survival goods. (…)

Abundance makes command relationships difficult to sustain and exchange relationships an almost pointless game. In gift cultures, social status is determined not by what you control but by what you give away.

…Thus the multi-millionaire’s elaborate and usually public acts of philanthropy. And thus the hacker’s long hours of effort to produce high-quality open-source code

What does gift culture mean with respect to education? My guess would be that we will see (and are already seeing) a rise in people offering the outcome of their learning for free and supporting the learning process of others (see Github, Blog- and Videotutorials, Substack, LinkedIn). Because if you published that library on Github or filmed that Tutorial on sourdough breadbaking, everyone can see for themselves, judging by forks/likes/followers (1) whether you have knowledge in a specific area and (2) what your social standing is in the relevant community.

Preliminary conclusions:

There is room for a social (professional) network of ‘teachers’ that bundles Github repos, blogposts and videos.

Use some of your spare time during the lockdown to write/film a tutorial about something you learned outside of university/school.

Don’t envy people at Harvard. Instead, start a newsletter.

🤓 Learnings

Currently learning about: Personal Finance & Sustainable Investing 💸

There is no indication that investing with a focus on sustainability has a negative impact on returns.

When it comes to measuring the impact of sustainability on investment returns, there are obviously a lot of factors that play a role: the definition of sustainability, the way of measuring sustainability, benchmarking etc.

In order to reduce complexity, I decided to leave all these specifics aside for the start and spent some time researching papers/reports that somehow tackle this relation of sustainability and investment returns. The result of my mini-meta study was (at least to me) positively surprising: I wasn’t able to find a single article reporting a negative correlation [2]. Some papers come to the conclusion that sustainability and returns are entirely uncorrelated while others find evidence for a positive relationship, but bluntly speaking, with regards to returns there seems to be no reason not to consider sustainability in investment decisions [3], [4].

Further, in 2020 private investors made up a 20% share of U.S. equity trading volume - that is a rise of 4% in comparison to 2019. While institutional investors obviously still control the vast majority of stocks, this means we as individuals, and with that our investment decisions, are of increasing importance [5].

✨ Random

Comfortable shoes have been in high demand in 2020 - the footwear brand ‘Crocs’ was able to sell an all time record number of shoes

A website that turns every word into a color

[1] In case you are more of a visual thinker:

[2] One potential reason for this (other than the non-existence of a negative relationship) could be publication bias, i.e. studies reporting negative effects are not getting published due to societal pressure. While I do not see a way to ultimately exclude this possibility, I would argue that any such study would need to be based on the same data as the currently published studies. Given the variety of sustainability measurement approaches and applied benchmarks, I would further assume that it is a rather difficult exercise to build a new valid sustainability metric that then supports a negative performance effect with respect to a sensible benchmark.

[3] The situation might look different when taking into account other factors such as e.g. volatility and of course this is not applicable on an individual level, i.e. comparing stock A to stock B.

[4] Some sources:

Majority of ESG funds outperform wider market over 10 years, Financial Times

The Performance of Sustainability Indexes, Finance India

Sustainable Equity Funds Outperform Traditional Peers in 2020, Morningstar

From ‘why’ to ‘why not’: Sustainable investing as the new normal , McKinsey

Does the ESG Index Affect Stock Return? Evidence from the Eurostoxx50, Sustainability